Facing the Fiscal Cliff By: Malini Nayar

About the Author

Malini Nayar is a community development finance professional with over 20 years of experience in finance, credit, and risk management. She has overseen investments in affordable housing, schools, and sustainable energy projects nationwide, and has served on nonprofit and educational boards. Her work is rooted in fiscal prudence, equity, and community impact — principles she will bring to her approach to school board governance.

FACING THE FISCAL CLIFF: LONG-TERM BUDGET CHALLENGES IN SOMSD

By Malini Nayar

For more than a decade, I have watched my children grow up in SOMSD schools — from Tuscan to MMS, and now as CHS students. Like so many parents in our community, I have seen firsthand the creativity, care, and commitment that define our classrooms. These schools are where my family has found belonging, where friendships were formed, and where I have witnessed the best of what public education can offer.

At the same time, I have watched as the fiscal pressures mount. The cost of educating our children continues to rise faster than the revenue limits set by law. Temporary federal relief funds have expired, state aid remains constrained, and inflation stretches every dollar further. Across New Jersey and the nation, public schools are being asked to do more with less. For a progressive, community-focused district like SOMSD, these pressures are compounded by federal headwinds that seek to restrict curriculum on equity and inclusion, limit funding flexibility, and potentially impose programs that may conflict with local priorities.

In this context, Superintendent Bing’s formation of the Budget Advisory Committee (BAC) during his first year (2024–25) was a meaningful step forward, bringing transparency, expertise, and community voices into one conversation - a much - needed step forward as he reconstructed the Business Office and focused on repairing community trust. We were invited as candidates to attend the most recent BAC meeting, and Paul had the opportunity to learn alongside returning members and hear directly from district leadership about both challenges and progress. The meeting reaffirmed that our fiscal path is complex and must be approached collaboratively, with discipline, transparency, and shared purpose.

I am committed to using my two decades of experience in community development finance to provide thoughtful oversight, guide strategic fiscal decisions, and protect the classrooms, teachers, and programs that make SOMSD schools the heart of our community.

If elected, we pledge to think long-term and look holistically at the many competing urgent needs in both the operating budget and the District’s Long Range Facilities Plan, making the difficult tradeoffs that put our core obligations to all students first, meeting the most critical needs and explaining clearly to the community the basis for our decisions.

Understanding the Challenge

Each year, the District must balance two realities:

Costs are rising rapidly — for salaries, benefits, transportation, and services.

Revenues are constrained — largely limited to local property taxes (capped at around 2% annual growth) and modest state aid increases.

Our basic reality is that our fixed costs – most notably salaries and benefits – are rising every year at a higher rate than our ability to increase revenue to pay for them.

To close the gap, the District has increasingly relied on one-time revenues — such as fund balance (surplus), withdrawals from reserve accounts, and temporary federal relief programs — to pay for recurring operating expenses. While this practice helps balance the budget in the short term, it creates long-term risk. Once those one-time sources dry up, the gap reemerges, often forcing deeper and more painful cuts to programs and staff.

Some past decisions have exacerbated these pressures. For example, selling the District’s bus fleet and relying entirely on outside vendors has increased costs for in-district special education transportation. More recently, staff reductions have strained classrooms and morale.

Where We Stand Today

For the 2025–26 school year, SOMSD adopted a $194.8 million budget that includes:

$11.35 million in fund balance (surplus) for operations, and

$1.13 million for debt service.

That use of surplus is nearly three times higher than the District’s historic average. In recent years, the District has also tapped:

Capital Reserve and Maintenance Reserve funds,

Interest earned on unspent bond proceeds from the 2019 capital referendum, and

Pandemic-era relief funds such as ESSER (Elementary and Secondary School Emergency Relief) grants, which temporarily offset expenses tied to learning recovery and facility upgrades.

These resources have helped bridge recent gaps, but they were never meant to fund ongoing operations. ESSER funds, for instance, expired in 2024 — removing a critical cushion that had supported staffing and student services.

Even with a 6% increase in state aid for 2025–26, the District faces continued cost growth that far outpaces revenue. The result: another year of difficult tradeoffs. In 2024, 28 staff positions were eliminated to close a remaining $2.7 million shortfall.

The largest cost drivers include:

Salaries and benefits – Payroll, health insurance, and paraprofessional costs have surged, with some categories rising more than 50% in recent years.

Transportation and special services – Rising expenses for special education transportation, tuition, and legal costs add millions annually.

Diminished reserves – The District’s once-healthy savings have declined as fund balance and reserves are used to fill gaps.

Revenue constraints – Property tax increases are capped, and state aid growth remains modest.

The Bigger Picture: Structural Challenges

Beyond this year’s budget, the District faces systemic pressures that make long-term stability difficult to achieve.

Unpredictable Cost Growth

Healthcare premiums, benefits, and special education services are increasing much faster than revenues. Health insurance costs alone are projected to rise by over 40%, and utility costs by over 25%. These increases outpace inflation and state aid, leaving little room to maneuver.

Enrollment Uncertainty

Enrollment stabilized around 6,700–6,800 students after pandemic declines, but projections vary. State models forecast growth, while local estimates suggest flat or modest declines. Because state aid is partly enrollment-driven, this uncertainty makes planning even harder.

Declining Reserves

To balance the 2025–26 budget, the District used $11.35 million from fund balance plus $2.5 million from the Maintenance Reserve. Withdrawals from Capital Reserve and other one-time sources have become recurring practice. If current trends continue, reserves could be significantly depleted by 2026 — leaving little flexibility to handle emergencies like roof failures or boiler breakdowns.

Aging Infrastructure

SOMSD’s buildings need major upgrades. The 2025 Facilities Needs Assessment, conducted by the Spiezle Group, identified over $372 million in capital improvements across schools, including $146 million in urgent year-one and year-two needs. These projects are typically funded through bond issuances — long-term borrowing repaid via local taxes and limited state debt service aid.

Currently, the District’s annual debt service is $13 million on $190 million in outstanding debt, with only 22% covered by state aid. The remainder is paid by taxpayers. Balancing these capital needs while protecting classroom investments requires strategic long-term planning.

Fixed vs. Flexible Spending

Because roughly 90% of the District’s operating budget goes to salaries, benefits, and mandated services, discretionary cuts often target enrichment, electives, and student supports — the very programs that define a well-rounded education.

Community Expectations

Over 90% of SOMSD’s General Fund revenue comes from local taxes. Raising taxes beyond the 2% cap would not be sustainable and would burden families already stretched by high costs of living. Fiscal sustainability must go hand-in-hand with educational excellence and fairness to taxpayers.

Listening and Learning: Insights from the Budget Advisory Committee

A step toward greater fiscal transparency came when Superintendent Bing formed the Budget Advisory Committee (BAC) in his first year (2024–25) — As candidates, we were invited to join the committee this fall for their initial meeting to learn alongside returning members, and to hear directly from Superintendent Bing, Business Administrator Imani, and Communications Director Eshaya.

At the October 7, 2025 meeting, key updates included:

Communication and Transparency – The district’s budget materials are now housed under the “Business/Budget” section of the website. Members suggested posting materials 24–48 hours before public town halls and eventually creating dedicated event pages for easier access.

Budget Overview – The Superintendent shared progress made in restoring fiscal stability after years of fund balance declines, highlighting the January 2025 budget freeze that helped achieve a FY25–26 budget without staff layoffs. The district’s goal is to save $9 million this year toward rebuilding reserves.

Financial Management Improvements – SOMSD has rebuilt its Business Office, transitioned to electronic payments, and established monthly reconciliations to ensure oversight.

Fiscal Outlook & Long-Term Planning – Rising costs for paraprofessionals, healthcare, and transportation continue to be the main headwinds. Efforts are underway to expand in-district special education capacity (ERI classrooms), pursue Energy Savings Improvement Program (ESIP) projects, and maintain advocacy in Trenton for equitable state funding.

Contextual Realities – Superintendent Bing noted that the district continues to navigate the aftereffects of expiring pandemic-era relief funds, which temporarily bolstered budgets but have now ended, compounding long-term structural pressures. He also noted that many of our peer districts, such as Montclair and West Orange, also face significant budgetary challenges.

These discussions underscore the Superintendent’s and BA’s focus on early planning, transparency, and fiscal discipline — priorities that align closely with the community’s desire for accountability and proactive problem-solving.

The Risks of Inaction

If these structural challenges are not addressed, SOMSD risks:

Deferred maintenance leading to costly emergencies

Continued staff reductions and declining morale

Unsustainable reliance on reserves and one-time funds

Erosion of public confidence in the District’s financial management

A Path Forward

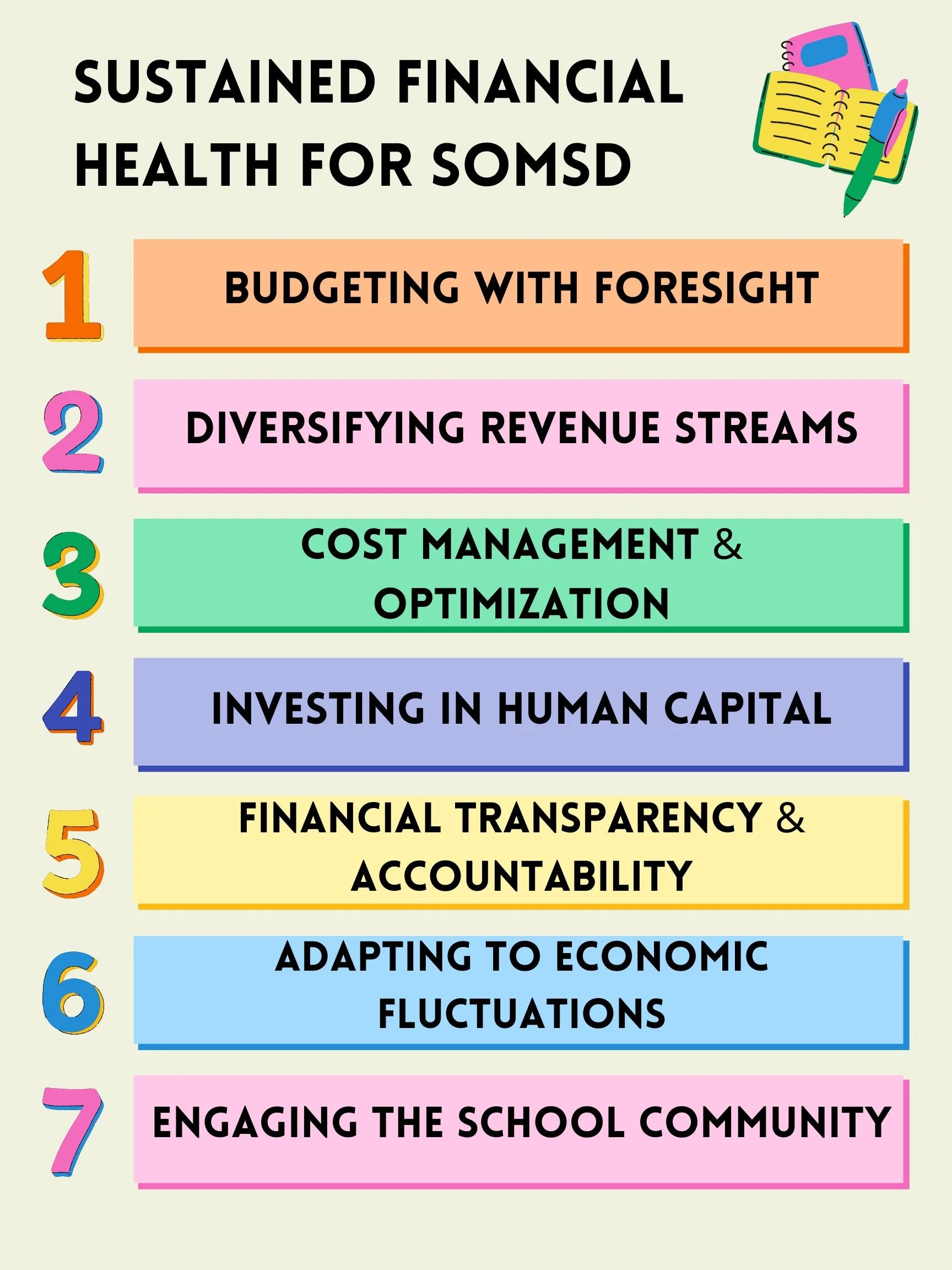

There is no single fix, but several strategies can strengthen our financial footing:

Targeted Zero-Based Budgeting: Review every expense annually rather than assuming past budgets are the baseline. The Superintendent has rolled this out but it requires further training of administrative and teaching staff, which is a worthwhile investment.

Advocate for Fair State Aid: Push for reform of New Jersey’s “census-based” special education funding formula and engage ahead of the 2028 Educational Adequacy Report (EAR).

Improve Efficiency: Expand shared services, pursue energy savings initiatives, and evaluate in-house vs. contracted transportation. We met with sustainability focused leaders and will be sharing our position on environmental sustainability within the District.

Strategic Staffing: Manage long-term salary costs through balanced hiring and targeted professional development, that could include SEED, Universal Design for Learning, and other tools that have a long-term impact. Additionally, the District should consider bringing the paraprofessional staff in-house and invest in their development, which will facilitate long-term planning and boost morale

Diversify Revenues: Pursue grants, partnerships, and creative collaborations with local organizations.

Plan Ahead: Build 3–5 year projections that anticipate trends before they become crises. This could include evaluating and projecting our District’s future expenses based on realistic assumptions of enrollment, major costs, and revenue sources so that we can plan to rebuild our diminished reserves and make thoughtful decisions about tax escalations and debt carry.

Engage the Community: The recently created BAC could be further enhanced with industry experts that can provide feedback and input to the Superintendent. Additionally, the District could consider more budget town halls, open dialogue and invite residents into the budgeting process. Meaningful transparency builds trust — and trust drives collective solutions.

A Shared Responsiblity

SOMSD stands at a crossroads. Our community’s commitment to strong, equitable public education is unwavering — but fiscal reality demands that we plan carefully, act strategically, and work together.

The Board’s role is not to manage day-to-day operations but to ensure the District is well managed for the long term. That means asking tough questions, setting clear priorities, and building consensus around sustainable solutions.

With thoughtful leadership, community partnership, and a clear financial roadmap, SOMSD can stabilize its finances without compromising its mission. The fiscal cliff is real — but it is navigable if we confront it together.